Diminishing balance method calculator

Although most microfinance institutions target the eradication of poverty as their primary motive some of the new entrants are focussed on the sale of more. Marginal Benefit 11250 5000 15 5 Marginal Benefit 625 per chocolate Since the next set of chocolates are priced higher 625 than what the consumer in willing to pay 5 he will not buy the next 10 chocolates.

How To Calculate Food Cost With Calculator Wikihow Food Cost Food Business Ideas Food Truck Business

Get notes on National Solar Mission National Mission for Enhanced Energy Efficiency National Mission for Green India and more.

. Calculator for depreciation at a declining balance factor of 2 200 of straight line. This method depreciates at a high rate for the start of an assets life and has a reducing rate each year. Casey Butts Maximum Mass Potential Calculator indicates.

What does Diminishing Balance Interest Rate mean. EMI payment every month contains interest payable for the outstanding loan amount for the month plus principal repayment. Reducing Balance Rate or the Diminishing Rate is used to calculate the interest amount for overdraft.

Includes formulas example depreciation schedule and partial year calculations. Moving Beyond Body Types. These are Straight-line depreciation and Diminishing balance method of depreciation.

You can also place a currency value on utility. The size calculator estimates MAXIMUM possible natural non-PED mass not inevitable possible mass. The Reality of Somatotyping.

You do not have to use the same method for all your assets. National Action Plan on Climate Change NAPCC was launched by the Indian government in June 2008. Depreciation for 2009 using Table A-1 is 100 million 20 20 millionDepreciation in 2010 100 million - 20 million 15 200 32 millionDepreciation in 2010 using Table 100 million 32 32 million.

Some government banks also offer microfinance to the eligible categories of borrowers. Declining or reducing method of depreciation results is diminishing balance of depreciation expense with each accounting period. Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule.

The Reducing Balance Method is mainly used to calculate the total interest for housing or mortgage property loans wherein the interest to be paid by the customer is calculated based on the outstanding loan amount after periodic repayments. The straight line method SL This method depreciates at the same rate each year. The different types of institutions that offer microfinance are.

Since utility is an arbitrary value of consumer satisfaction it can be measured as a unit called utils For example imagine if you were at a restaurant you could say the utility of one glass of soda is four utils meaning that you derive this much value from one soda. Using the percentage Declining balance depreciation method. Utility Quantified as Utils.

In these situations the declining balance method tends to be more accurate than the straight-line method at reflecting book value each year. Work out diminishing value depreciation. Work out straight line depreciation.

In Diminishing Balance Interest Rate method interest is calculated every month on the outstanding loan balance as reduced by the principal repayment every month. Enter the email address you signed up with and well email you a reset link. Depreciation per year Book value Depreciation rate Under this system a fixed percentage of the diminishing value of the asset is written off each year so as to reduce the asset to its residual value.

Where the early years need to be weighted more heavily its better to use the diminishing value or reducing balance method of depreciation as this gives a more accurate result. The Reality of Diminishing Arm Size Progress. In the 2nd year it could depreciate 20 on the remaining balance that is 1500 leaving the balance of 6500 and so on.

When you buy an asset like a. In Straight-line depreciation fixed amount of depreciation is followed whereas in Diminishing balance a fixed rate is followed and the amount of depreciation decreases along with the changing value of the opening balance of the machinery. If you bought the truck for 50000 it would be worth 40000 after the first year 32000 after the second year and so on.

Important Questions with Answers for CBSE Class 11 Economics Part B Unit 2 Consumers Equilibrium and Demand which is outlined by expert Economics teachers from the latest version of CBSE NCERT books. A It is the want satisfying power of the commodity. Which of the following statements regarding utility is not true.

MACRS declining balance changes to straight-line method when that method provides an equal or greater deduction. Steroids induce a greater average positive nitrogen balance.

Loan Interest Calculation Reducing Balance Vs Flat Interest Rate Loan Calculation Calculator Method Inte Interest Calculator Intrest Rate Finance Guide

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

Depreciation Formula Examples With Excel Template

Depreciation Of Fixed Assets In Your Accounts Marketing Process Accounting Small Business Office

Depreciation Formula Calculate Depreciation Expense

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

Flat Interest Rate Vs Reducing Balance Rate Types Of Loans Interest Rates Interest Calculator

Declining Balance Depreciation Calculator

Declining Balance Depreciation Calculator Template Msofficegeek

The Art Of Food Cost Control Bid Sheet Controlling Purchasing Chefs Resources Food Cost Food Truck Business Restaurant Business Plan

Overhead Recovery Rate Calculator Double Entry Bookkeeping Overhead Recovery Excel Spreadsheets

Ashworth A02 Lesson 8 Exam Attempt 1 Answers

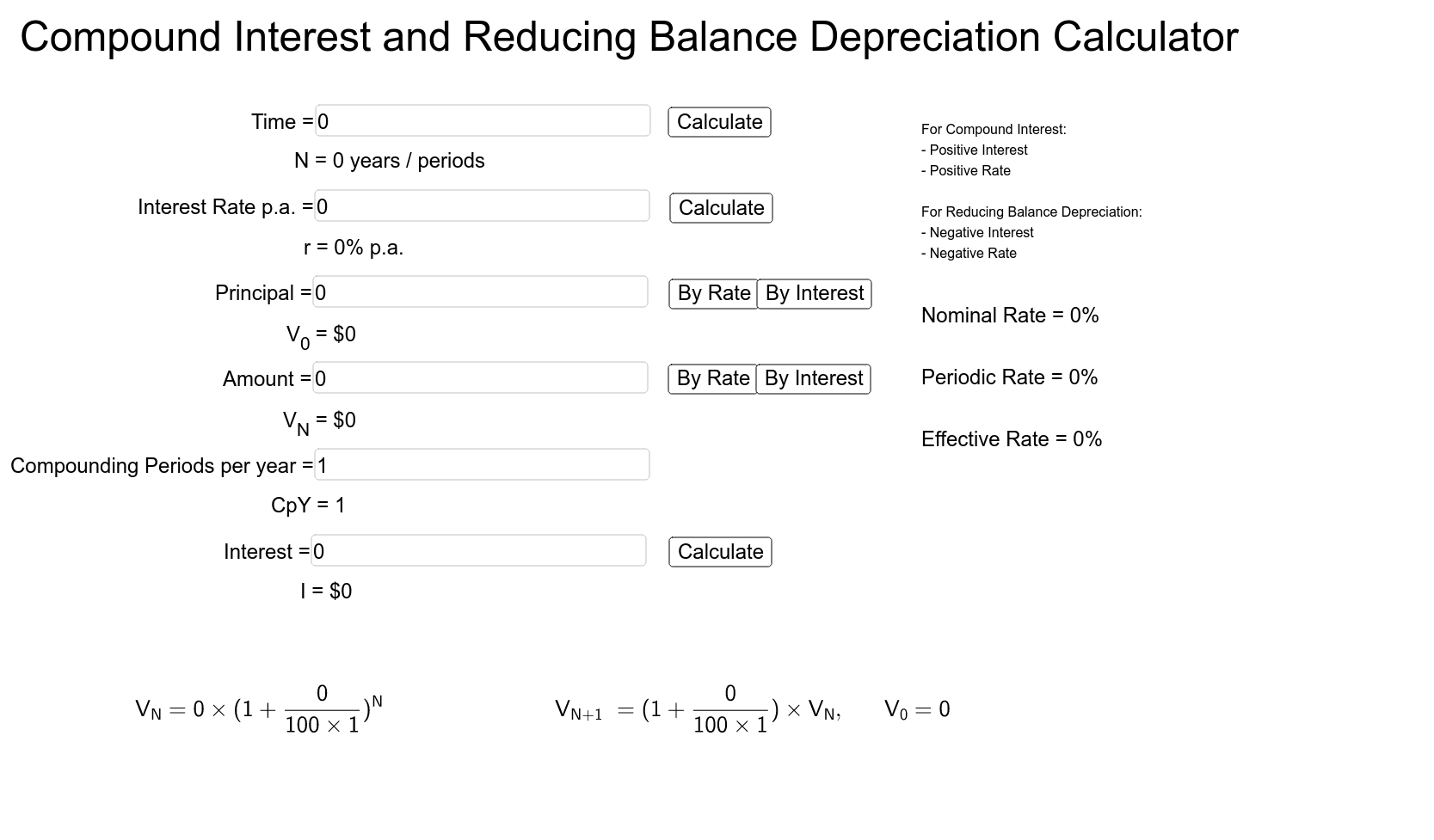

Compound Interest And Reducing Balance Calculator Vce Geogebra

Reducing Balance Depreciation Calculator Double Entry Bookkeeping